In recent years, topics related to ESG (environmental, social, and governance) have generated significant awareness in the Chinese economic and political spheres.

ESG in China

For foreign companies operating in the Chinese market the ESG landscape has been changing and will continue to do so. The following report answers two major questions:

- What are ESG rules and regulations in China?

- How can European companies integrate both local and global standards into a cohesive ESG reporting strategy?

Summary

China has been actively developing its ESG framework, aligning with international standards and pushing for greater sustainability and carbon neutrality. ESG investing and reporting are still in early stages. Challenges such as data disclosure, a lack of unified reporting systems, and greenwashing remain.

At the same time, the EU has updated its ESG reporting requirements, and the regulations also target European companies operating in China. Since 2024, the Corporate Sustainability Reporting Directive by the EU has been active. European enterprises of a certain size with operations in China need to report their ESG impact and navigate both local and global standards in ESG reporting.

For European companies operating in China, it is therefore crucial to keep an eye on the most recent developments and integrate global as well as local standards into a cohesive ESG reporting strategy.

A Timeline of ESG in China

The term ESG was first introduced internationally in 2004 through the “Who Cares Wins” report by various financial institutions supported by the UN.

In China, ESG has been on the agenda since 2008, when the Shanghai and Shenzhen stock exchanges mandated CSR reports (Corporate Social Responsibility) for enterprises in specific indices. However, these early reports did not emphasize sustainability goals. The prominence of ESG in China grew significantly in 2016 with the release of the “Guiding Opinions on Building a Green Finance System,” which aimed to establish mandatory environmental information reporting for companies listed on Chinese stock markets.

In recent years, the Chinese government has increasingly championed sustainability-related agendas. In September 2020, President Xi Jinping announced China’s commitment to peak CO2 emissions before 2030 and achieve carbon neutrality before 2060. This “Dual-Carbon” (双碳) goal has pushed ESG reporting and investing to the forefront of policy and corporate policies.

In 2021, the Standing Committee of the National People’s Congress included ESG-specific regulations in the Draft Amendment to the Company Law, emphasizing “social responsibility.” Despite the existence of various rules and regulations, the ESG landscape in China has remained somewhat fragmented. Reporting is predominantly mandatory for enterprises in polluting sectors and some public firms, covering about 500 companies. The majority of ESG disclosure remains voluntary. Nonetheless, ESG reporting is gaining more and more traction, especially when looking at listed, internationally oriented enterprises. According to the 2023 Caixin Whitepaper of ESG development, in 2022 nearly 35% of listed A-share companies published ESG data.

ESG Reporting in China

ESG in China: What Are the Most Recent Rules and Regulations?

In recent years, China has been working to establish a more comprehensive framework for ESG initiatives, aiming to align its ESG rules with EU regulations.

In 2022, the China Enterprise Reform and Development Society published comprehensive voluntary ESG guidance for state-owned and private companies in all industries for the first time. The guidance is intended to serve as a working document to unify ESG practices throughout China. It provides detailed guidelines for conduct related to the three pillars of ESG:

Environmental:

- Resource management (e.g. water)

- Preventive and curative measures (e.g. recycling, energy efficiency, pollution management)

- Waste emission control

Social:

- Employee rights (e.g. insurance, health and safety, gender equality)

- Product liability (e.g. product safety and quality, manufacturing standards)

- Social responsibility (e.g. public interest and civic responsibility, critical incident response capacity)

Governance:

- Governance structure (e.g. diversification, shareholding, ownership and control structure)

- Governance mechanisms (e.g. accountability, voting, executive incentives)

- Governance effectiveness (e.g. corporate culture, information transparency, customer and data privacy, compliance development, ethics, innovation, risk management)

The guidelines adhere to international ESG standards and practices, serving not only as a guide for enterprises but also aiming to unify the ESG landscape within China and internationally. Additionally, these guidelines are seen as a means to promote sustainable development and support Chinese policies, such as the “dual carbon” goals and the “dual circulation” strategy.

China: New ESG Guidelines on Chinese Stock Exchanges Since 2024

In February 2024, the three largest stock exchanges of China, the Shanghai, Shenzhen, and Beijing Stock Exchange, published new ESG disclosure rules for their largest companies. The regulations differ in their target groups: The Shanghai Stock Exchange and Shenzhen Stock Exchange target only firms continuously listed in the relevant indices and are mandated to disclose their information. The Beijing Stock Exchange, on the other hand, focuses on small and medium enterprises and makes disclosure voluntary.

The regulations stipulate that enterprises need to disclose their ESG reports by 2026, covering governance and strategy as well as risk management and metrics and targets. Transparency in environmental concerns and commitment to sustainability and energy transformation are the key aspects of the newly published guidelines and need to be aligned with the Chinese government’s domestic environmental and social policies.

In 2023, of around 5000 A-listed companies on the Shanghai and Shenzhen Stock Exchanges only about 1800 issued ESG reports. While mandatory ESG reporting has mostly been in place for major polluters and companies with a history of environmental violations (see Administrative Measures for Legal ESG Disclosure of Enterprise Environmental Information), the published guidelines can be seen as one step further towards a more binding, holistic approach to ESG regulation in China.

ESG Reporting for EU Companies with Business Relations in China

The EU’s “Corporate Sustainability Report Directive” (CSRD) has entered into force in January 2024. It mandates companies with operations in the EU to report on their ESG-related initiatives, which should also include the entities’ value chains and operations outside the EU. European companies with business operations in China therefore need to provide ESG-relevant data regarding their international undertakings.

Corporate Sustainability Report Directive: EU Companies with Subsidiaries in China Affected

In November 2022, the EU adopted the “Corporate Sustainability Report Directive” (CSRD), which requires companies to report ESG and CSR related data. The CSRD replaces the EU’s 2014 “Non-Financial Reporting Directive” (NFRD) and widens the scope of companies required to publish their reports. Starting from 2024 or 2025 respectively, around 50.000 companies, including non-EU companies with significant operations in the EU, will be mandated to publish their ESG reports. The following categories of businesses required to publish their reports include:

- Enterprises that were already obliged to publish reports under the EU’s NFRD. For these companies, publishing their reports will be mandatory from 2025. Companies should therefore begin data collection in 2024.

- Entities to which two of the following criteria apply: more than 250 employees, turnover of more than 40 million € per year, and/or balance sheets exceeding 20 million € in total are required to report starting from 2026. Data collection is required from 2025.

- All companies with securities listed on EU-regulated markets need to publish reports starting from 2027 and should therefore begin data collection in 2026.

- Subsidiaries with parent companies outside EU are required to publish ESG-reports by 2029.

EU Reporting Standards for the CSRD: What Data Should EU Companies Collect from Chinese Subsidiaries and Partners?

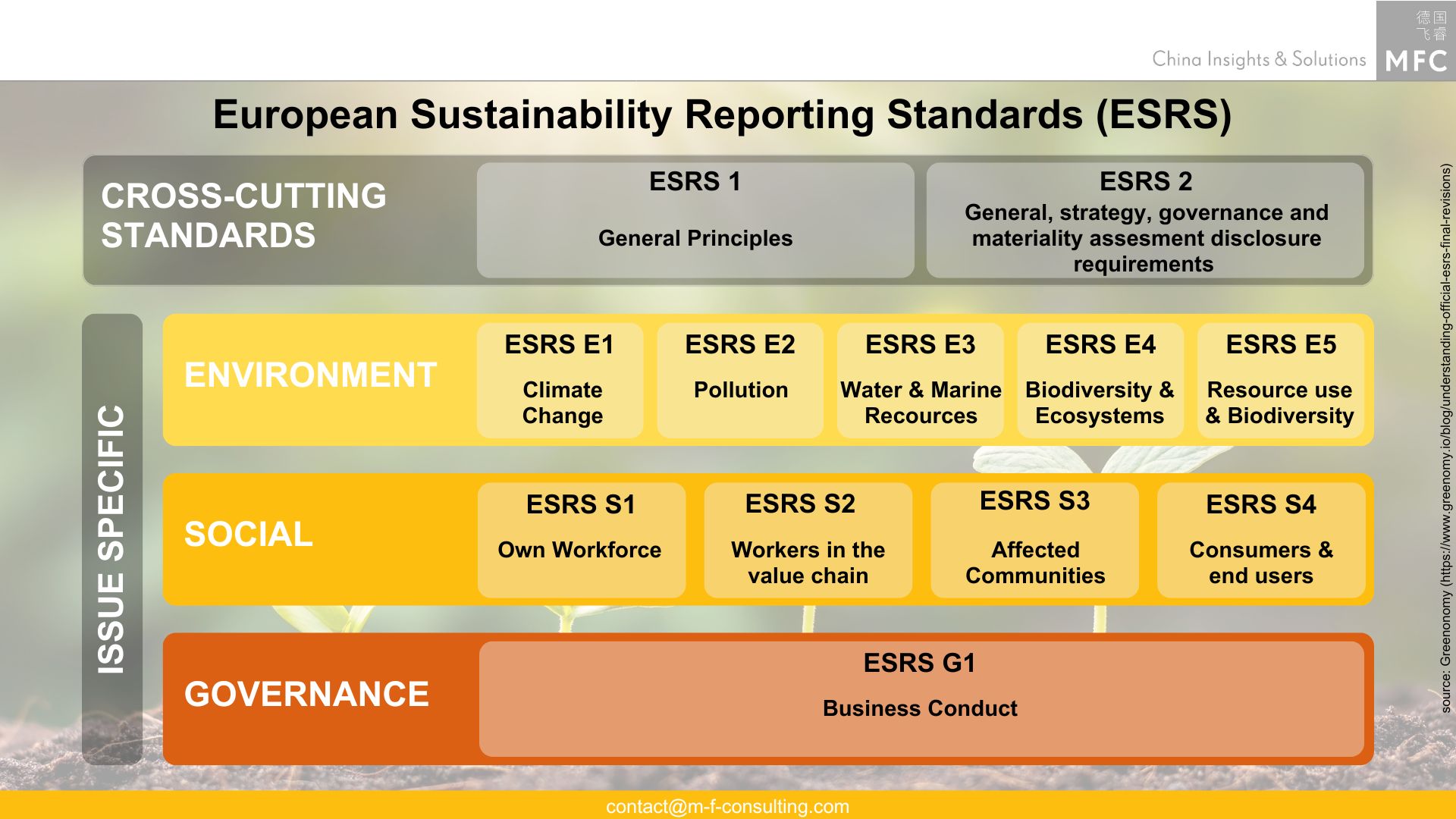

Under the EU’s Corporate Sustainability Reporting Directive (CSRD), Chinese subsidiaries and partners of EU-based companies will need to provide comprehensive and standardized sustainability information. The key requirements are detailed in the European Sustainability Reporting Standards (ESRS), which form the basis for the CSRD disclosures. Here are the main areas they need to cover:

To illustrate the application of the ESRS for an EU-based company with subsidiaries and local partners in China, consider the hypothetical example of an EU food company. This company has established a subsidiary in China and contracted a local manufacturer to produce goods for the Chinese market. Here is a brief breakdown of the data it needs to collect from China:

Environmental reporting:

- Climate change: Greenhouse gas (GHG) emissions including:

- Direct GHG emissions from company-owned vehicles

- indirect GHG emissions from electricity purchased by contracted manufacturers

- and emissions related to the entire supply chain, including transportation of product distribution, and end-of-life disposal.

- Pollution: Documentation on pollutant emissions and waste management.

- Water Use: Data on water usage and wastewater treatment practices.

- Biodiversity: Data on deforestation and land use practices from upstream raw material suppliers

- Resource Use: Information on resource efficiency, such as the use of recyclable packaging and reduction of food waste.

Social Reporting:

- Own workforce: Diversity, safety, and training data

- Workers in supply chain: Labor practices at contracted manufacturing sites: including fair wages, working hours, and safety conditions

- Affected community: Impact to local communities including economic contributions and community development projects.

- Consumers and end-users: Product safety and quality standards maintained by the subsidiary and manufacturers.

Governance Reporting:

- Corporate Governance: Ethical practices and anti-corruption measures.

CSRD Guidelines and Double Materiality for EU Companies in China

This breakdown only serves as a general guidance. For detailed requirements, each company should develop its own specific lists tailored to the particular industry. Each company must consider the unique aspects of their operations and supply chains to ensure comprehensive and accurate sustainability reporting.

In addition, after collecting the required data, EU companies should proceed with conducting a double materiality analysis to assess both the impact on the business and its effect on sustainability and describing processes to mitigate negative impacts and risks. The assessment of double materiality refers to both to financial risks as well as the enterprise’s own impacts on people and the environment.

ESG Reporting in China: Challenges

Despite progress, several challenges hinder the development of ESG practices in China. The major challenges include:

- Lack of data disclosure: With ESG reporting being voluntary for most companies, only a limited amount of data is publicly available. Quantitative and comparable information is thus impossible to gather.

- Lack of a unified reporting system: The absence of a standardized reporting system results in inconsistent quality and scope of ESG reports across enterprises. Additionally, ESG ratings can vary significantly, especially when comparing national and international rating agencies.

- Greenwashing: The growing interest in ESG investments has led some institutions to claim ESG compliance to attract investors without implementing appropriate measures.

- Compliance with domestic and international standards: International enterprises with subsidiaries in China need to not only adhere to domestic rules and regulations but also bear in mind international guidelines such as the EU’s new CSRD.

ESG in China: Outlook

The Chinese government is striving for nationwide unification of ESG reporting, aiming to increase participation and improve the quality of ESG reports among companies. China’s Ministry of Finance published a first draft on new ESG reporting standards in May 2024. According to the explanatory document, the Chinese government seeks to establish a unified mandatory reporting system by 2030 with key standards to be established by 2027.

This initiative aligns with China’s broader sustainability and carbon neutrality goals. As a result, firms operating in the Chinese market must thoroughly understand the most relevant policies and regulations.

China is actively developing its green finance and technology market and is expected to continue these efforts. The Shanghai and Shenzhen stock exchanges plan to make ESG reporting mandatory for their largest listed enterprises by 2026, further enhancing accountability in ESG practices.

Internationally, China aims to align its ESG practices with EU regulations and adhere to international standards. The Chinese ESG guidelines draw inspiration from the EU’s “Corporate Sustainability Reporting Directive”. This is yet another means by the Chinese government to attract more foreign investment and capital.

ESG Reporting: 9 Tips for European Companies in China:

- Align business strategy with ESG goals: Develop a comprehensive strategy encompassing sustainable, social, and governance practices to aid decision-making processes and demonstrate reliability to stakeholders.

- Adhere to international guidelines: For European companies it is incremental to adhere to the EU’s regulations on ESG and CSR, following the newly published EU’s Corporate Sustainability Reporting. Further alignment with international ESG standards like the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD).

- Understand and compare EU and Chinese regulatory requirements: Study the EU’s CSRD to understand the specific ESG reporting requirements, including metrics, timelines, and documentation standards while identifying relevant Chinese ESG regulations such as the Green Finance Guidelines etc. to understand the differences and similarities between these and the EU regulations.

- Establish a common framework: EU companies shall consider developing their own unified set of ESG metrics that satisfy both EU and Chinese regulations. This might involve aligning definitions and methodologies for key indicators such as carbon emissions, water usage, labor practices and governance structures. They should implement consistent templates and formats for data collection and reporting to streamline the process and reduce duplication.

- Set clear and measurable ESG goals: Establish clear ESG goals aligned with your business strategy to create a long-term ESG plan and ensure accountabilities for all involved parties.

- Publish regular ESG reports: Implement a regular reporting schedule and be transparent about achievements and challenges to foster accountability among stakeholders.

- Build robust data collection and verification system: EU companies may need to invest in new technologies and processes to improve data accuracy and reporting efficiency. This might involve adopting advanced data analytics tools, implementing blockchain for supply chain transparency, or collaborating with local partners to ensure consistent and reliable data flow.

- Strengthen communication and collaboration with stakeholders:

- Local team: Ensure that HQ in EU and their local teams in China are trained and well-informed about reporting requirements. Regular training sessions and workshops can help maintain compliance.

- Local partners (suppliers, distributors, etc.): Collaborate closely with Chinese suppliers and partners to ensure they understand and adhere to reporting requirements. Consider cultural differences and negotiate with local partners, starting, for example, with emphasizing Chinese ESG priorities, such as environmental protection and common prosperity when communicating requirements to local partners.

- Communicate success stories and challenges: Share ESG case studies and success stories to build trust and showcase your company’s approach to ESG.

Are you looking for a sustainable market-strategy in China or do you seek support for your ESG reporting? Then contact us to learn more about how we can assist you. Follow us on LinkedIn for more insights and updates.